Cost per use calculator for big purchases, in hours of work

A simple way to judge big-ticket items: convert the true price into cost per use and into hours of your time.

Introduction

Eyeing a £1,200 phone, a £700 washing machine, or putting down a deposit on a used car? The real question isn't just “can I afford it,” but “how many hours of my life will each use cost?” This guide shows a calm, practical way to decide. You'll get a no-nonsense cost-per-use method, clear formulas, realistic examples, and a quick calculator to turn big-ticket choices into confident yes/no answers including a 60-second checklist for buy, rent, or wait decisions.

Cost per use, explained in plain English

Cost per use takes everything you'll pay over an item's life, subtracts what you'll get back when you sell it, and divides by how many times you'll use it. That's more honest than comparing sticker prices because it accounts for running costs, maintenance, and resale. If you searched for a “Cost per use calculator for big purchases”, this is exactly that approach and we'll also express the result in hours of work so the trade-off feels real.

Seeing costs in time helps you feel the swap you're making today for something else you could do tomorrow. People often find this reduces impulse buys because “£200” can feel abstract, while “13 hours at my rate” is crystal clear.

What counts as a “use”?

- Appliances: per wash or per cycle.

- Cars and e-bikes: per commute, per trip, or per mile (be consistent with your running-cost data).

- Laptops and phones: per day of primary use.

- Tools and gear: per outing or job.

The formula: from price tag to hours per use

1) Cost per use = (Purchase price + total running & maintenance costs over life - expected resale value) ÷ expected number of uses.

2) Hours per use = Cost per use ÷ your net hourly pay.

Example: if your take-home pay is £15/hour and cost per use works out to £2.70, each use costs 0.18 hours (about 11 minutes). That's easy to weigh against the value you'll get from the item.

Reality check: want a benchmark for hourly pay? See the latest UK medians in the ONS Annual Survey of Hours and Earnings. The figure is gross hourly pay for full-time employees, while our calculator uses net (take-home), so expect your personal hourly rate to be lower. Source: Office for National Statistics.

What counts as a 'use' for big purchases? Make sensible estimates

- Washing machine: uses = loads per week x weeks owned. UK manufacturer guidance suggests lifespans of roughly 7-13 years; see Beko's explanation of when to replace a washer. Example: 2 loads/week x 52 x 10 years ≈ 1,040 uses.

- Laptop/phone: uses = days in service x sessions per day. To avoid over-counting, many people use “days of primary use” (e.g., 250 days/year for three years ≈ 750 uses).

- Car or e-bike: you can define a use as a trip or as a mile. Stay consistent with your costs if you use pence-per-mile, calculate on a per-mile basis.

When in doubt, be conservative. Over-optimistic estimates of usage make almost any purchase look good on paper.

Worked examples you can copy (appliance, laptop, car)

1) Washing machine

- Purchase: £700; expected resale: £100.

- Uses: 2 loads/week x 52 x 10 years ≈ 1,040 uses.

- Running/maintenance: assume £0.12 electricity + £0.08 water per load = £0.20 per load.

- Total ownership cost: £700 - £100 + (1,040 x £0.20) = £808.

- Cost per use: £808 ÷ 1,040 ≈ £0.78.

- Hours per use (net £15/hr): £0.78 ÷ 15 ≈ 0.052 hours ≈ 3.1 minutes.

2) Laptop

- Purchase: £1,200; expected resale after 3 years: £300.

- Uses: 250 primary-use days/year x 3 = 750 uses.

- Running: minimal beyond electricity; assume £0.02 per day → £15 total.

- Total ownership cost: £1,200 - £300 + £15 = £915.

- Cost per use: £915 ÷ 750 ≈ £1.22.

- Hours per use (net £15/hr): £1.22 ÷ 15 ≈ 0.081 hours ≈ 4.9 minutes.

3) Car (per-mile)

Combine ownership costs (insurance, tax, servicing, depreciation) with energy per mile. For energy, the RAC's 2025 comparisons suggest around single-digit pence per mile to charge an EV at home and roughly low-teens pence per mile for petrol at typical prices. See RAC's methodology and latest assumptions: RAC cost-per-mile guide.

- Ownership cost (illustrative): £2,400 per year.

- Mileage: 8,000 miles/year → ownership cost per mile = 30p/mile.

- Energy: assume 5p/mile EV home charging (or 13p/mile petrol) → pick the figure that matches your vehicle.

- Total cost per mile: 30p + 5p = 35p/mile (EV at home). Petrol example: 30p + 13p = 43p/mile.

- Hours per mile (net £15/hr): £0.35 ÷ 15 ≈ 0.023 hours ≈ 1.4 minutes.

These are examples to show the method. Plug your numbers into the calculator below.

Rent, buy, or wait? Find the break-even number of uses

Break-even uses = Total ownership cost ÷ rental (or subscription) price per use.

Example: a camera costs £1,000 to own over its life and hiring is £35/day. Break-even is ~29 days. If you'll use it fewer than that, renting wins. Factor in convenience, storage, and risk of under-use; then rerun the maths if your plan changes.

Financing, warranties, running costs, and resale: small inputs, big impact

- Financing: add total interest paid to ownership cost. If you only know the monthly payment, estimate interest as (monthly payment x term) - cash price.

- Warranties/repairs: include likely out-of-warranty repairs or keep a small per-use buffer.

- Running costs: sanity-check car energy using HMRC's Advisory Fuel Rates. For EV company cars, the Advisory Electricity Rate has been set in recent updates at single-digit pence per mile; public charging can be higher. See GOV.UK: Advisory Fuel Rates.

- Resale: use conservative resale values. Over-optimism skews decisions.

Tip: a quick ±20% sensitivity check on resale value or number of uses often flips the answer. Test the boundaries.

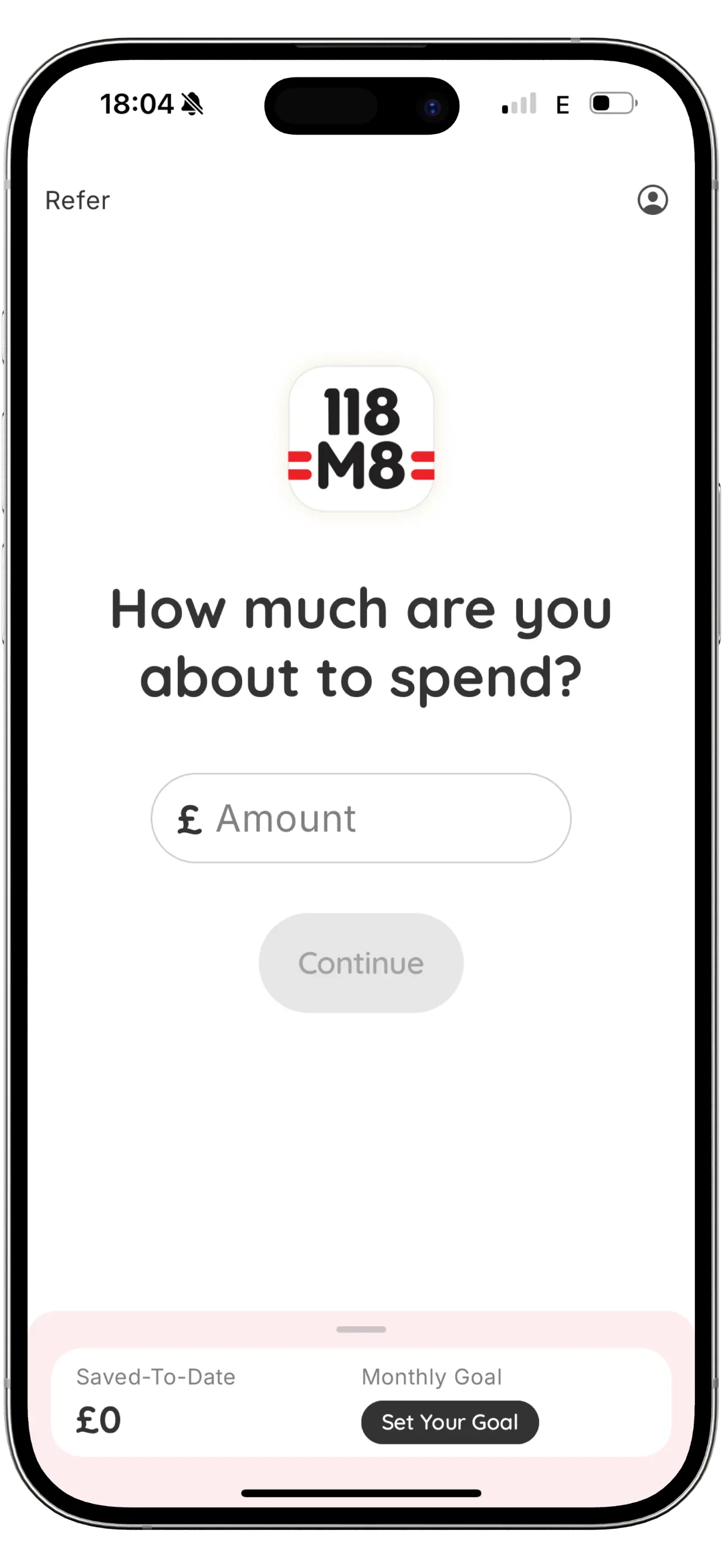

Try it now: Cost per use calculator (in hours of work)

Enter your numbers below. You'll instantly see cost per use (£), hours per use, and whether it crosses your personal threshold (default 15 minutes).

Common pitfalls: why the math can mislead if you're not careful

- Counting every tiny interaction as a “use” (inflates value).

- Ignoring running costs like electricity, consumables, servicing, or insurance.

- Assuming rosy resale values.

- Underestimating maintenance or repairs.

- Forgetting financing interest or fees.

- Anchoring on sale prices and not the total you'll actually pay.

Do it faster with 118M8: see prices in hours of work before you buy

118M8 is a free, simple companion for iOS and Android that turns any price into hours at your rate. Enter your take-home hourly pay, log potential purchases, tap Sleep on it for a 24-hour pause, and watch your savings grow when you decide not to buy. It's the same method you've used in this article-just quicker and always with you.

Quick checklist: a 60-second decision before any big purchase

- Estimate uses (trips, cycles, days, or miles).

- Add running/maintenance costs.

- Subtract a conservative resale value.

- Divide to get cost per use.

- Convert to hours per use using your net hourly pay.

- Compare against your personal threshold (e.g., 15 minutes).

- Buy, rent, or wait 24 hours and store the numbers to revisit later.

Stock images by Cht Gsml, Parul Gupta, PlanetCare, Barry A, Anton Savinov, Nick Fewings, Muhammad Daudy and aceofnet via Unsplash.