Introduction

Choosing a budget method is easier when you match it to how you 're paid. UK paydays don 't always line up with monthly bills, and during a cost-of-living squeeze that mismatch can be the difference between calm and chaos. In this guide we compare the popular 50/30/20 rule with zero-based budgeting and give a verdict by pay frequency. You 'll also get a 3-minute tool to pick your fit and practical UK setup steps so your plan works with real bills like Council Tax, TV Licence and energy.

50/30/20 vs zero-based budget (UK): quick definitions and where each shines

50/30/20: a simple split of your after-tax income into needs (50%), wants (30%), and saving or debt (20%). UK banks explain it as an easy way to balance priorities - see Lloyds Bank 's 50/30/20 overview or HSBC 's guide to spending your income. Percentages are guides; you can flex them.

Zero-based budgeting: every pound gets a job before the month starts - bills, sinking funds, savings, even a small buffer. Media coverage has highlighted its behavioural benefit of tracking where each pound goes; for example, the Guardian describes the rise of zero-based budgeting in the UK as an “every penny has a purpose” approach.

Where each shines

- 50/30/20: fast setup, low admin, good for steady monthly salaries and people who prefer broad categories.

- Zero-based: best for tighter budgets, variable income, or when you want maximum control and faster debt repayment.

UK paydays explained: monthly, weekly, 4-weekly (and week 53) - why timing changes your budget

UK payrolls use frequency codes such as weekly, fortnightly, four-weekly and monthly. Employers report these to HMRC through Real Time Information (RTI). You can see the frequency codes listed on GOV.UK 's RTI reporting guidance.

Some sectors still pay weekly or four-weekly, while many office-based roles pay monthly. The challenge is that most household bills - rent or mortgage, Council Tax, and utilities - are charged monthly by calendar date. If you 're paid weekly or four-weekly, you 'll regularly face months with five Fridays or a “week 53” in PAYE terms. HMRC explains how week 53/54/56 is handled for PAYE and National Insurance in its employer guide; in short, there 's special treatment in those final weeks which can nudge take-home up or down in that period (CWG2 PAYE/NI guide).

This timing mismatch is why a simple 50/30/20 split can wobble on weekly or 4-weekly pay unless you actively smooth cash flow across calendar months.

Which fits your payday? Recommendations by pay frequency

Monthly

- Default: 50/30/20.

- Why: Aligns naturally with monthly rent/mortgage, Council Tax and direct debits.

- Tweak: If essentials regularly exceed 50%, flex to 60/20/20 or 70/20/10 for a few months and review.

4-weekly

- Default: Zero-based.

- Why: 13 pay cycles meet 12 billing months; a job-by-job plan plus a “smoothing pot” bridges short months and five-week calendars.

- Tweak: Move a fixed amount from each payday into a Monthly Bills pot and pay Council Tax/TV Licence/energy from there.

Fortnightly

- Default: Zero-based.

- Why: Keeps track of alternating 2- or 3-paycheque months and avoids bill-date misses.

- Tweak: Set due-dates just after the first payday of the month; top up a buffer on the second payday.

Weekly

- Default: Zero-based.

- Why: Maximises control across five-week months and week-53 quirks.

- Tweak: Drip-feed a fixed weekly amount into a Monthly Bills pot to cover rent, energy and Council Tax on time.

Irregular / freelance

- Default: Zero-based using “last month 's income”.

- Why: Controls volatility; fits months with fewer invoices. ONS RTI bulletins note ongoing pay variability across sectors (April 2025; June 2025).

- Tweak: Build a one-month buffer, then budget this month using last month 's cleared income.

| Factor | 50/30/20 | Zero-based |

|---|---|---|

| Setup time | Minutes | Longer (plan each pound) |

| Flexibility | High, broad buckets | Very high, category-level |

| Debt-repayment intensity | Moderate | High (assign extra to debts) |

| Best bill alignment | Monthly pay | Weekly/4-weekly/irregular |

When 50/30/20 breaks in the UK - and how to fix it

In high-cost areas or during energy spikes, essentials can easily exceed 50%. Financial coverage has questioned how realistic a rigid split is in those conditions; for instance the Financial Times has discussed budgets under pressure. Don 't force the rule - adapt it:

- Flex the split: try 60/20/20 or 70/20/10 for a season, then revisit when costs ease.

- Create sinking funds: spread annual bills (car insurance, MOT, TV Licence) monthly.

- Debt sprint: switch to a temporary zero-based plan and funnel every spare pound at priority debt until you 're back to steady ground.

Pick in 3 minutes: Budget Fit Checker

Answer three quick questions and get a recommendation plus your first move for this payday. If you 're already in arrears, treat priority bills first and use a zero-based plan until things are stable. For help ranking bills, see MoneyHelper 's Bill Prioritiser.

Recommended method

50/30/20

Aligned with monthly bills; keep admin light.

First move this month

Set direct debits for the week after payday.

Sample allocation next payday

Needs 55% · Wants 25% · Saving/Debt 20%

Remember: cover priority bills first (rent/mortgage, Council Tax, energy). See MoneyHelper guidance.

Make any method UK-proof: setup checklist for your next payday

- Confirm take-home: check your payslip after tax/NI/pension/student loan deductions.

- List priority bills: rent/mortgage, Council Tax, gas/electric, water. Set direct debits for just after payday.

- On weekly/4-weekly pay: create a Monthly Bills pot and drip-feed a fixed weekly amount to hit calendar due dates.

- Add annual/quarterly items: TV Licence, MOT, car insurance - turn them into monthly sinking funds.

- Student loans: payroll takes repayments automatically; budget the net pay you actually receive.

- Keep a buffer: a small £50-£200 pot softens surprises.

- Review monthly: adjust categories and pot amounts as prices move. For planning help, try MoneyHelper 's Budget Planner. If you 're unsure of your pay interval, HMRC lists the frequency codes on GOV.UK. For wider pay trends, see the latest ONS RTI bulletin.

Head-to-head: outcomes that matter

| Outcome | 50/30/20 | Zero-based |

|---|---|---|

| Setup time | Very quick (bank explainer frameworks like Halifax 50/30/20) | Longer, but tailored |

| Maintenance effort | Low | Medium-high (track more often) |

| Bill alignment by pay frequency | Best with monthly | Best with weekly/4-weekly/irregular |

| Irregular income suitability | Fair (needs buffer) | Strong (budget last month 's income) |

| Debt payoff intensity | Moderate | High |

| Behavioural benefit | Simplicity encourages consistency | Tracking each pound builds awareness (Guardian) |

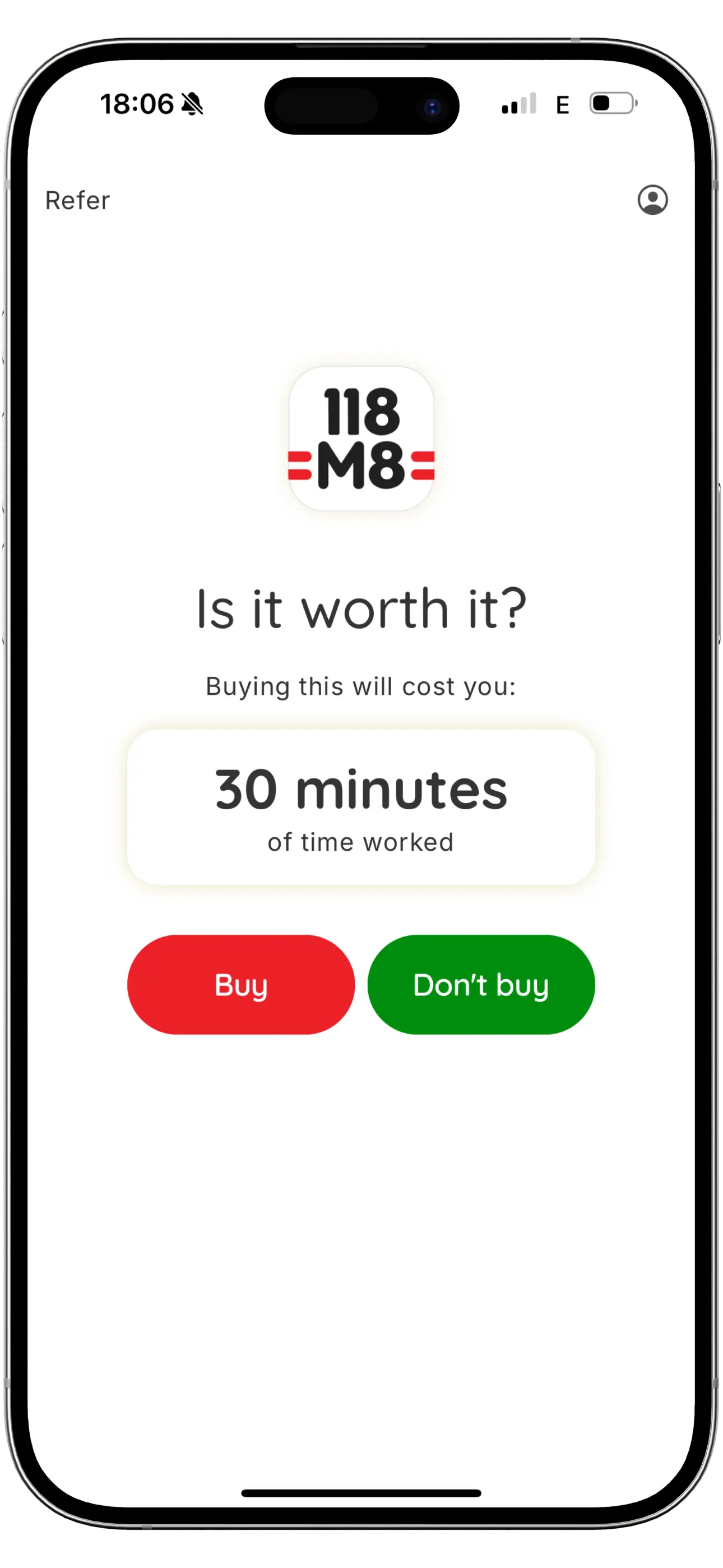

Make it stick day-to-day: see prices in hours worked with 118M8 (free)

UK FAQs: common gotchas and quick fixes

How do I handle week 53 or five-week months?

Use a smoothing pot. For PAYE specifics, HMRC 's employer guide explains week 53/54/56 handling for PAYE and NI - useful background when your final payslip looks different (CWG2).

Can I mix methods?

Yes. Many people use 50/30/20 as a monthly cap and then assign jobs within each bucket using zero-based categories.

What if I 'm already in arrears?

Prioritise bills in order of urgency (housing, Council Tax, energy) using MoneyHelper 's Bill Prioritiser, then run a zero-based plan until you 're stable.

Irregular income?

Budget from last month 's cleared income and build a one-month buffer. If income swings are large, review weekly.

Annual bills in a monthly budget?

Create sinking funds: divide the annual amount by 12 and transfer monthly into a dedicated pot so renewals never derail you.

Conclusion: your best-fit budget for your payday

Match the method to how you 're paid and how variable your income is. As a rule of thumb: Monthly → 50/30/20 (flex as needed); 4-weekly/Weekly/Irregular → Zero-based + smoothing pot. Try your pick for 30 days, review, and adjust. Use the Budget Fit Checker above and the MoneyHelper planner to map categories - and lean on 118M8 to add the daily pause that keeps any plan on track.

Stock images by Sincerely Media and Crystal Y via Unsplash.