24-hour rule to stop impulse buying: see cost in hours

Introduction

Impulse adds up fast. In 2023, U.S. shoppers reported about $151 a month in impulse spending, and a 2024 research roundup found it rebounded to roughly $282 per month. If that sounds familiar, here 's a calm fix: use the 24-hour rule and convert prices into hours of work before you buy. A mini calculator and a one-tap way to “sleep on it” are below.

What is the 24-hour rule to stop impulse buying?

It 's a simple commitment: for any non-essential purchase, wait 24 hours before buying. The short pause breaks the spell of instant gratification and present bias-our tendency to overvalue “right now” compared with later. That tiny gap is often enough for the urge to fade and for your goals to speak up.

- Extend to 48-72 hours for higher-ticket items, sales that trigger FOMO, or anything that costs many hours of work.

- What counts as non-essential? Wants you could delay without harm-tech upgrades, fashion, decor, convenience gadgets, dining out.

- Where to park it: add the item to a wishlist or a note; avoid leaving it in the cart where one-click checkout tempts you.

Learn more about present bias in this clear explainer from Investopedia.

See cost in hours worked: the simple math

Formula: hours to earn = item price ÷ your take-home hourly rate.

- At $18/hour: a $54 dinner ≈ 3 hours; a $360 phone upgrade ≈ 20 hours.

- At £15/hour: a £30 top ≈ 2 hours; a £600 laptop ≈ 40 hours.

Use net (after-tax) pay if you can-it reflects the real value of your time. Write the time cost next to each wishlist item, then apply the 24-hour pause.

Time-to-earn calculator

Enter your take-home hourly rate and the item price. We 'll show how many hours and minutes it costs.

Why waiting works: evidence from the brain-and from consumer law

When you see something you want, reward circuitry such as the nucleus accumbens lights up; when the price feels painful, regions like the insula engage. In a classic shopping study, these signals predicted purchases (Knutson et al., Neuron, 2007). A short pause lets the heat of the reward response cool so your reflective brain can weigh goals and trade-offs.

Policy makers build pauses in, too. In the EU and UK, most distance purchases include a 14-day cooling-off right-an institutionalised reflection window to reduce regret. See the official guidance on returns and cancellations. Your personal 24-hour rule is the same idea, scaled to everyday buys.

Set smart thresholds using hours, not pounds or dollars

Make your pause scale with your income. Because of present bias (we overweight now vs later), bigger time costs deserve longer waits.

≤ 5 hours → quick check, buy if it serves a priority > 5 hours → wait 24 hours > 20 hours → wait 72 hours Subscriptions adding > 2 hours per month → pause and reassess

Adjust these thresholds to your goals, debts, and upcoming bills. The point is to turn “Can I afford the price?” into “Is it worth my time?”

Make online triggers less tempting (and keep the 24-hour rule intact)

- Remove saved cards from browsers and retailers.

- Delete shopping apps and unsubscribe from promo emails/notifications.

- Disable 1-click checkout and BNPL auto-approval where possible.

- Use site/app blockers during late-night scroll hours.

- Always add items to a wishlist, not the cart, during your wait.

Surveys show buy-now-pay-later can fuel splurges-LendingTree found many emotional spenders say BNPL makes them more likely to overspend. Add friction so impulses fade.

24-hour rule playbook: a 60-second checklist

- Note the item and price.

- Convert the price into hours of work.

- Log it on a wishlist (not the cart).

- Set a reminder: 24 hours (72 hours if it 's a high-hour item).

- Check your budget and whether you already own a workable alternative.

- Re-read your short-term goals.

- Decide: buy, don 't buy, or delay again.

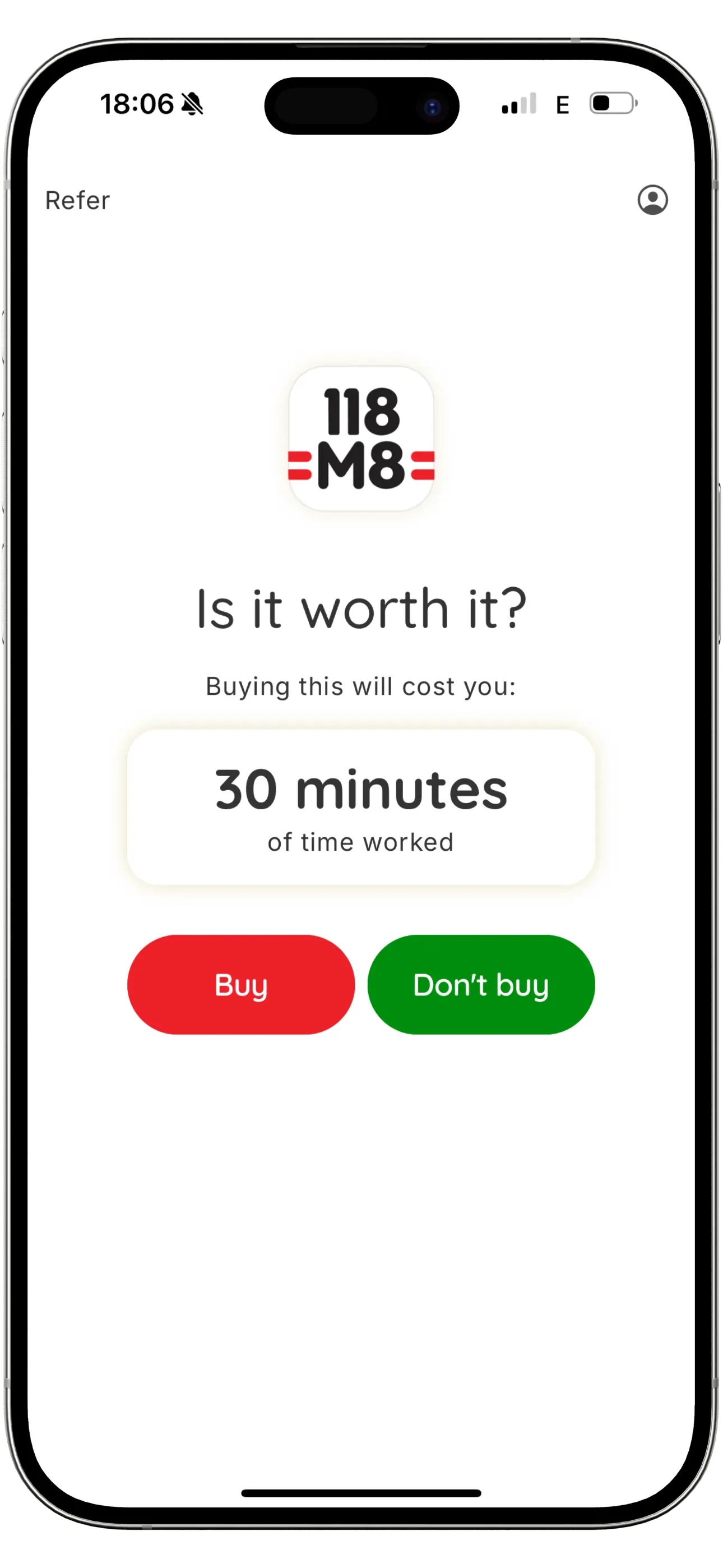

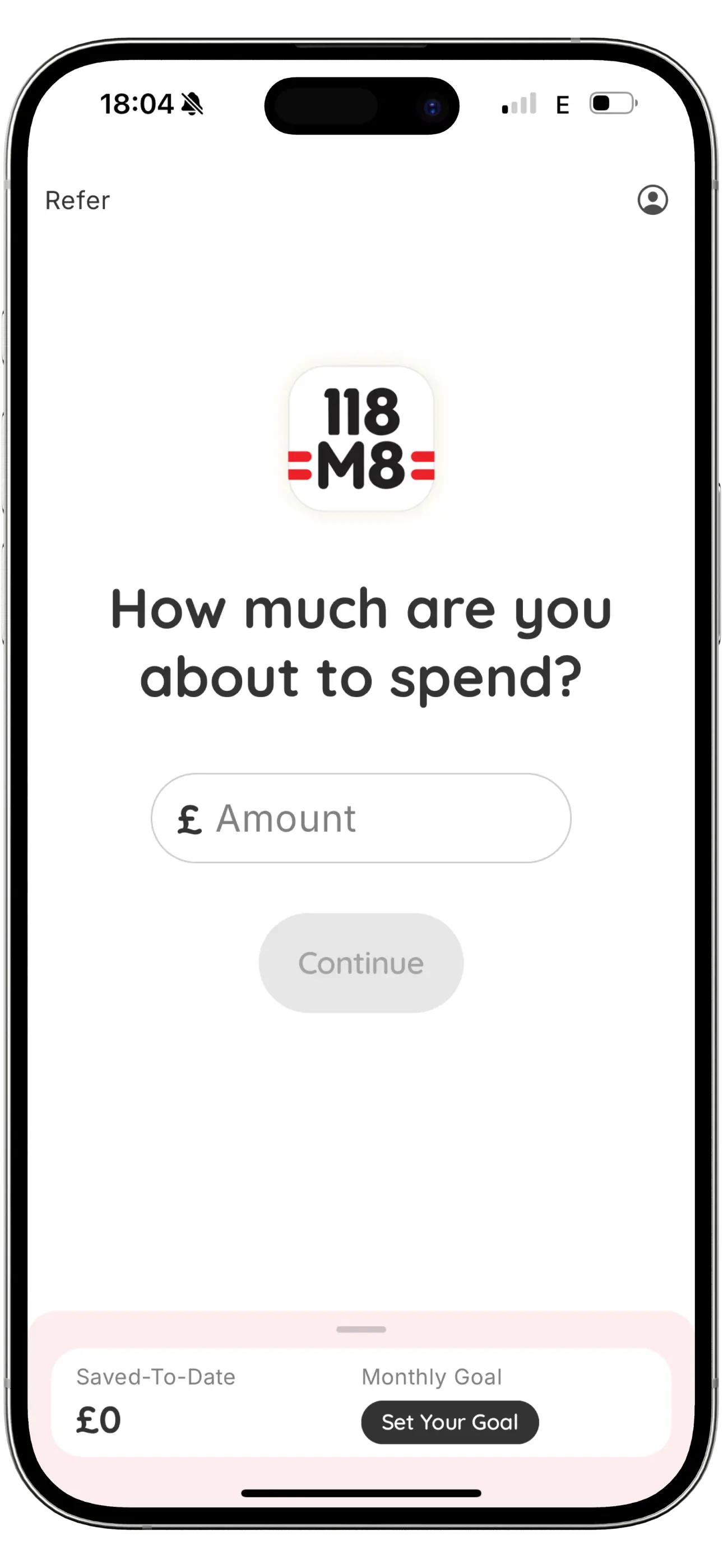

Make it automatic with 118M8 (free)

118M8 turns the rule into a habit. Enter a price and it shows the hours it costs. Tap Sleep on it for a 24-hour reminder, then track how many hours and pounds you 've saved when you don 't buy. Future features include spending alerts and subscription tracking for even fewer impulse buys.

Also see our guide: How to calculate the time-price of a purchase.

Stock images by Shutter Speed, Milad Fakurian, Marjhon Obsioma, Jonas Leupe, and Jakub Żerdzicki via Unsplash.